Reference for Tariff Threshold

Reference for Tariff Threshold

In general (except for EU countries), if the declared value of your parcel is below the tariff threshold of the destination country, it is unlikely to be taxed (unless it is fraudulently declared). If your parcel is taxed, you will need to pay the tax and assist with customs clearance.

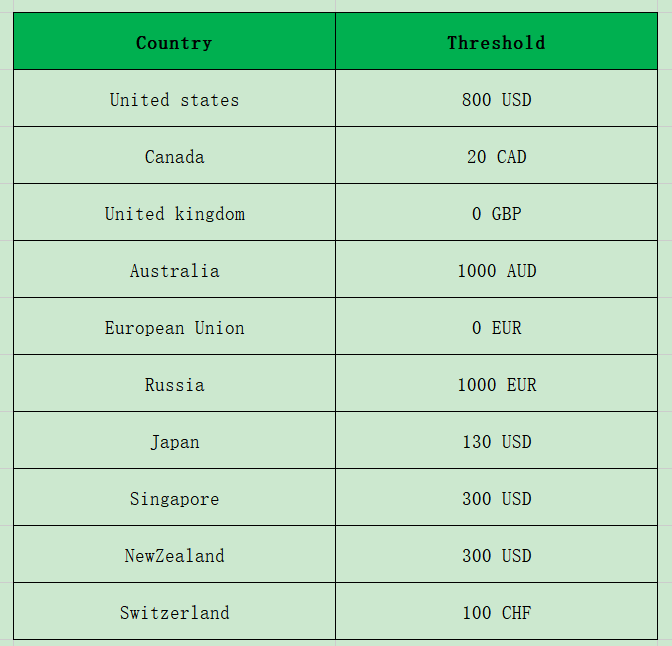

Tariff Thresholds by Country:

Reminders:

1. The tariff threshold for Switzerland is 100 CHF, and the VAT threshold is 65 CHF.

2. Canada and European customs are strict about package inspections. Commercial couriers like DHL, UPS, and FedEx are more likely to be taxed.

Parcel Shipping Tips:

1. The weight of the parcel is a key factor in determining whether it is considered a personal or commercial shipment by customs. Parcels weighing 10 kg or more are more likely to be classified as commercial shipments. Please consider the weight when submitting your parcel.

2. A large quantity of the same product in one parcel is also a factor that may classify it as a commercial shipment. Please avoid sending large quantities of the same product in a single package.

3. Due to customs regulations, please exercise caution when sending pharmaceuticals.

Important Notes:

The information above is sourced from online data collection and is for reference only, not as a standard guide.

Customs Clearance Notes:

For non-duty-free/non-IOSS supported routes, customs clearance fees are borne by the customer. Customs inspections are generally random. If customs deems your parcel to be special (e.g., large size, heavy weight, or contains sensitive items), they will usually contact the recipient to provide an invoice or customs clearance documents (customs clearance fees are borne by the recipient). Any fees resulting from the failure to contact the recipient or non-cooperation in customs clearance, which lead to the parcel being returned or destroyed, will be borne by the recipient.

If you need a customs invoice, you can download it from crazybuycn or contact our online customer service.